On Episode 3 of The Edge of Innovation, we think about the actors involved in big data. What does Google do with it? They sell ads.

Hacking the Future of Business!

On Episode 3 of The Edge of Innovation, we think about the actors involved in big data. What does Google do with it? They sell ads.

On Episode 2 of The Edge of Innovation, we’re talking about cryptocurrency. We have to translate currencies because banks assign them value. But for cryptocurrency, you could say “I want to buy a bitcoin.” Well what’s it worth?

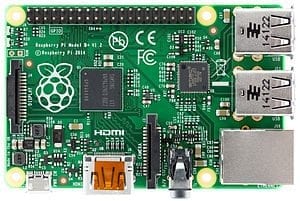

On this week’s podcast we talk about Raspberry Pi: what it is technically and the opportunities it presents.

What is Raspberry Pi? It is basically a small computer about the size of a credit card that has USB ports, memory, a CPU, and a video card. So, with adding a power supply to it and a little bit of software you could do just about anything you want.

What is the value in using this? The number of things that have been created using Raspberry Pi is incredible and there’s a huge opportunity from the business point of view to commercialize or productize to the point where a normal person, as I like to call them, not a nerd can go out and buy something on a shelf, plug it in, and have it work.

As we look at the value, an innovator may recognize that there’s a gap here and an opportunity. But there’s not a lot of distance from where we are right now to it being a common place thing. The ability to bridge that gap using this technology is what will enable inventors to hack the future.

We recently had an issue where we needed to edit a bunch of ProShow shows that we had on a local server. However when we tried to load the shows we were greeted with an error that the show assets could not be loaded. A quick call to the phenomenal tech support that Photodex provide confirmed our fears: ProShow does not work with assets on a network server.

The workaround was to copy the entire show locally. That worked, albeit a more than a little bit of a pain but workable.

So we let it ride and worked that way for a few weeks. Until it occurred to me maybe a mapped drive would work. Mapped drives are a throwback to DOS which basically sets a drive letter to access a network share.

Heck, try it… I mapped the network path to the drive letter J: and it worked. Cool.

Now we can open ProShows located on our server. Nice.

This tip presents an example of DataTable in Responsive using bootstrap. The DataTable.js automatically provides column sorting, searching and paging. DataTable.js is just like a .js file. It’s open source. In many of the applications, we need to display data as a table format so in this scenario, if we will use this library then it reduces our work and it increases the efficiency. Background DataTable.JS DataTable.js is just like a JavaScript library we can use in any web related projects. It automatically provides column sorting, searching and paging functionalities. Bootstrap Bootstrap is the most popular for HTML, CSS and JS framework for developing responsive applications. Responsive Responsive means the single application will target any device like mobile, tablet, small PC and …

Original Article Can Be Found Here:

Bootstrap Table With Sorting, Searching and Paging using dataTable.js (Responsive)